About Us

Innovating every solution for the optimal results you need.

Who we are

With over 10 years of experience in Software Development, Technology, and AI Solutions, i-Cube Digital Solutions is a Japanese-invested full-service IT solutions company based in the Philippines. We provide startups, SMEs, and corporations with customized tech solutions that cover the front-end, back-end, UI/UX, QA, and BA roles for Fortune 500 companies and startups locally and globally.

Why i-Cube

Located in the Philippines, I-Cube Digital Solutions has over 10 years of experience and expertise in handling the needs of startup and Fortune 500.

By innovating every solution and optimizing the workflow, we’ve created a reliable and seamless experience with every collaboration. Coupled with high standards we hold with every project and client, we built a system that works effectively and efficiently.

The IT Landscape in the Philippines

The Philippines is officially a bilingual nation, thereby distinguishing Filipino as the national language and both Filipino and English as the official languages for business communication. As of today, the primary verticals/sector of Information Technology Enabled Services (IT-ES) sector in the Philippines include software development and publishing, call centers, BPO, animation, production and sales of hardware components. The industry has showcased tremendous growth in terms of revenues. The growth is driven by increasing Foreign Direct Investment from foreign players and multiple employment opportunities available for Filipinos.

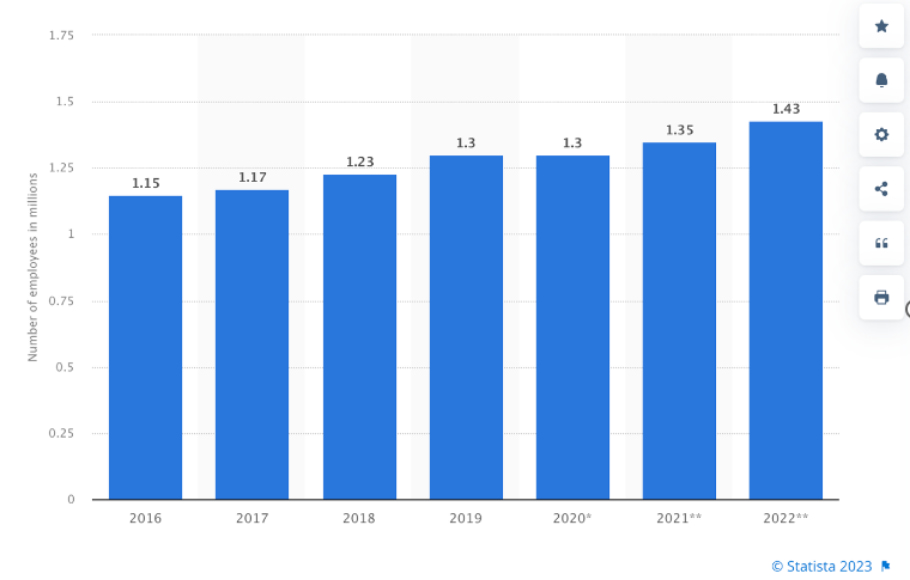

Number of employees in the IT-BPM market in Philippines from 2016 to 2022 (in millions)

The number of employees in the IT-BPM industry in the Philippines has grown to 1.43 million people in 2022.

The Philippines is the best country for outsourcing

Philippines IT-BPO Market

The BPO boom in the Philippines has not only been led by traditional low value-added call centers but also through high end outsourcing or KPOs. The country’s IT-BPO market revenues were observed to grow during the review period 2012-2018. Call/Contact centers comprise a major proportion of the Philippines IT-BPO sector and have been using their potential of creative design, talent workforce, large number of legal professionals and accountants. Competition within the Philippines IT-BPO market was observed to be mildly fragmented with the presence of both domestic and international players such as Accenture, Concentrix, Sutherland, 24/7 Philippines Inc, Teleperformance and others. The BPO industry of the Philippines is expected to get influenced by emergence of AIS (Artificial Intelligence Systems) for instance, AI-powered translators which would accelerate the wider use of English in the country

Philippines Software Market

Over the past few decades, software development in the Philippines has become one of the more established sub-sectors of the country’s IT and IT-ES industry along with the presence of both domestic and international firms that are capable of delivering services and products that match up with the rigid global standards. In comparison to the other Southeast nations like China and India, critical factors that are adding momentum to the country’s software industry are its cultural and western-accent similarities especially with the US; cost competitiveness and good knowledge in terms of IT background; thus, proving to be a more useful resource. Major Players operating within the Philippines software industry include IBM, Accenture, Genpact; UST Global, Pointwest, Existglobal, Capgemini, HP and others. Over the forecast period, Philippine's software market is expected to grow owing to the increasing number of software-centric startups within the country.

Philippines Antivirus Market

The growing concern for cybersecurity and prevention of virus attacks has led several Filipino companies to adopt total security solutions consisting of internet security, anti-spyware, malware, anti-virus and others. In terms of revenues, the country’s antivirus market showcased year on year growth during 2012-2018 and was dominated by the enterprise segment, followed by the retail segment. Most of the companies were witnessed to use Microsoft Defender instead of any other anti-virus system as it comes in a pre-installed format within the PC itself. Competition within the antivirus industry was witnessed to be moderately concentrated with the presence of a limited number of players in the country. Some of the leading companies in this segment are international namely Trend Micro, Sophos, Norton McAfee, Symantec, Kaspersky, Avast, ESET and others. However, several domestic firms have also been emerging in this market. Increasing number of internet users across various verticals is anticipated to boost the demand for antivirus solutions in the near future to avoid any data breach or illegal cyber activity.

Philippines Hardware Market

In accordance with the International Data Corporation, IT spending in the Philippines was observed to be majorly skewed towards hardware components. Majority of the IT spend by enterprises focused on purchase devices such as PC, laptops, smartphones, tablets and others. Philippines' hardware market size was witnessed to increase over the years both in terms of sales volumes and revenues. Competition within the Philippines hardware market was observed to be mildly fragmented with the presence of significant players such as Samsung, Acer, Apple, Asus, LG, Toshiba, Sony, Lenovo, and others. Over the forecast period of 2018-2023, the country’s hardware market revenues are further estimated to increase owing to a potential rise in the overall sales of computers and peripherals.

The Philippines Offshore Outsourcing Statistics

2021 POPULATION

111.44 Million

REAL GDP

$361.49B

LITERACY RATE

98.18%

EMPLOYMENT RATE (2021)

93.13%

GOVERNMENT SUPPORT

Full support to develop the IT industry